Splash out, save for a rainy day, or reduce debt to a trickle?

Here’s a thought for you; could you ‘earn’ more by paying off any debts you have, rather than saving the money? The savings vs. debt debate is common enough, and the answer is never completely straightforward. In the end, it all comes down to what sort of debt you have, and what sort of interest you can expect to earn from your savings.

How much interest are you paying on your debt?

Generally, the higher the interest rate you’re paying on a debt, the more you have to gain by reducing it. Credit cards and store cards usually have high interest rates, typically around 17% APR, so it’s a good idea to clear as much of this sort of debt balance as you can.

How much could you save by paying off more of your debt?

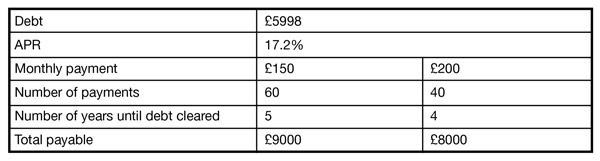

If you have the UK’s typical consumer borrowing debt of £5,998 (excluding mortgages1)* and are paying the average interest rate of 17.2%, the example below shows you how much you could save by increasing your monthly payment. You can actually save yourself £1,000 and clear the debt one year early just by increasing your monthly payment by £50!

Payday loans are even more penalising on interest, often posting interest rates of around 1,750% APR. These should always be cleared first. Of course, not all debt has such high interest rates as payday loans and credit cards. Many personal loans – such as car loans and student loans – have lower interest rates. Mortgage rates are also low right now.

What really matters is this: are you paying a higher rate of interest on your debts than you can expect to receive from your savings? How much can you expect to be paid in interest from your savings? UK savings rates are currently very low, and have been for a few years.

They are generally around the 1.8% mark and, importantly, lag way behind credit card, overdraft and most loan rates. This means you are likely to lose more money paying credit card interest than you can earn by putting your money in a savings account.

Let’s look at a simple example. If you had £1,000 in a savings account and earned 2% interest, you would earn £20 in interest. If you owed the same £1,000 on a credit card with a 17.2% interest rate, it would cost you £172 in interest. In other words, by clearing your debt instead of saving, you would be £152 better off.

Clearly, it pays to pay off your higher interest rate debts first – credit cards, payday loans, even unauthorised bank overdrafts. You’ll be better off by doing so. You can then make the most of your money by looking at what interest rate returns are available in the savings market.

[divide]

About the author

Debt Free Direct helps all kinds of people manage all kinds of debt. They will take the time to find out about your situation and help you find the best solution for you. Their advice is confidential and they could help you write-off up to 65% of your debt. To find out if they can stop your creditors chasing for payment and reduce your debts into one affordable monthly payment, call 0800 116 4952 or visit their website to find out more.

1. www.creditaction.org.uk

2. Average amount written off for our clients between March 2012-March 2013.

[divide]

Picture: Shutterstock